Case study

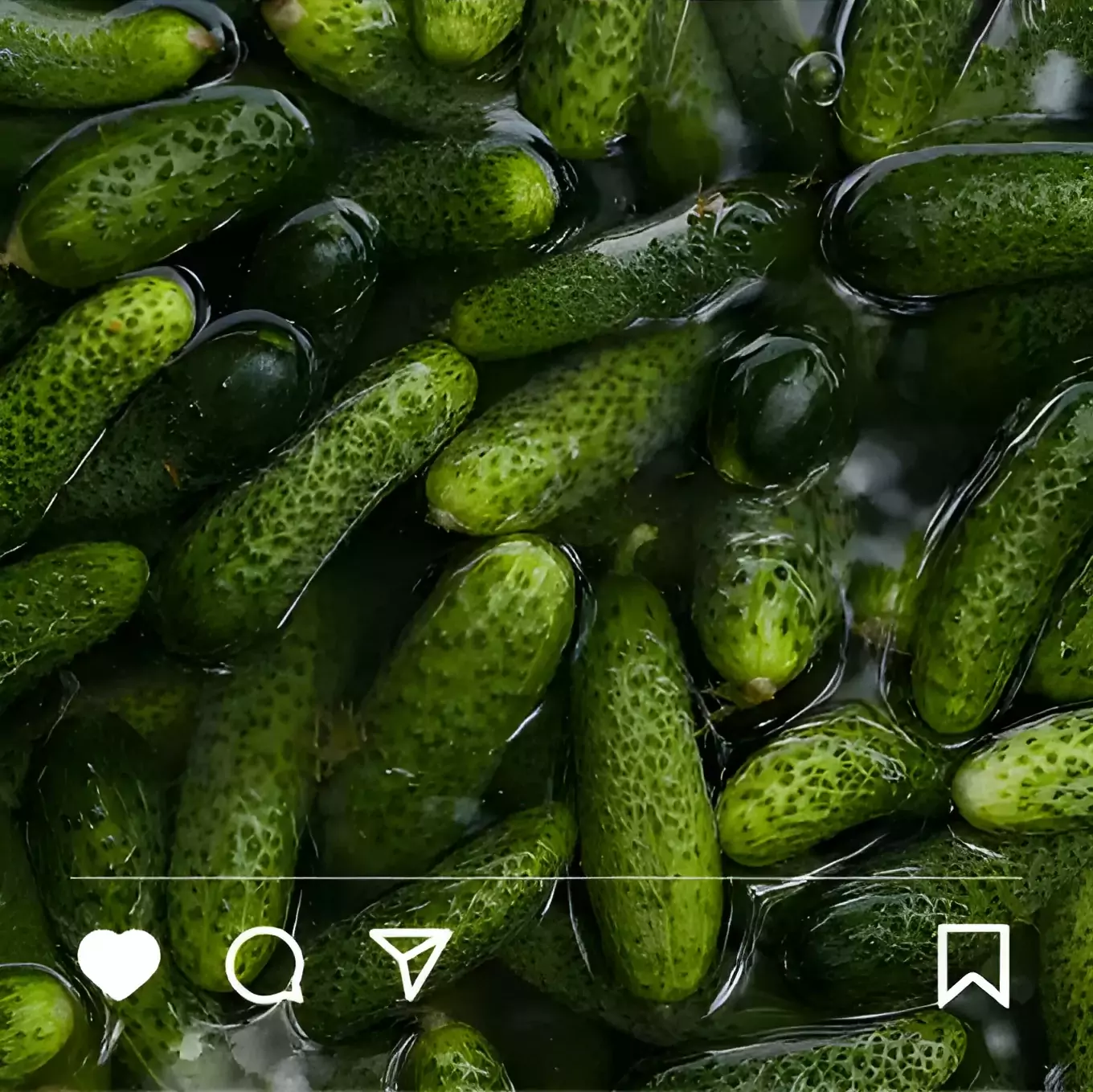

Use case 1: A pickle company goes viral

A pickle company experiences overnight success and needs to keep up with a spike in demand.

To get supplies—vinegar, cucumbers, jars—they take out an MCA. Soon—despite increased revenue—those daily ACH withdrawals begin to drain their cash flow.

A factoring company wants to fund them, but the UCC filing from the MCA blocks the deal from moving forward. FundingCue steps in, buys out the MCA, restructures repayment, and clears the UCC.

With the lien gone, the factor can fund the business—and the pickle company will continue to scale production without missing a beat.

Use case 2: A legacy trucking company

A well-established trucking company has steady revenue, reliable clients, and long-term contracts in place.

To meet increased demand, they decide to expand their fleet. They need the trucks—so it makes sense to take out an MCA. But the advance comes with a daily draw and a lien on receivables.

The business is still in great shape, but the UCC and cash flow pressure make it ineligible for factoring.

FundingCue pays off the MCA, eliminates the lien, and enables a factor to take the deal, so that this business can continue to scale—on stable ground.